MBA in Finance

MBA Finance programs encompass a comprehensive curriculum designed to delve into financial management, investment analysis, organizational finance, and the intricacies of financial markets. These programs equip students with the analytical and managerial skills necessary to excel in the finance sector.

Full Form of MBA: The full form of MBA is “Master of Business Administration.”

Core Area of MBA in Finance

Financial Management: Covers topics such as capital budgeting, cost of capital and financial decision-making.

Wealth Management: Focuses on investment analysis, portfolio management, asset valuation, and strategies for wealth maximization.

Corporate Finance: Explores corporate financial policies, capital structure decisions, dividend policy, and corporate governance.

Objectives of MBA Finance

Develop Financial Expertise: Equip students with comprehensive knowledge and skills in finance.

Enhance Analytical Abilities: Critical thinking and analytical skills necessary for evaluating financial data.

Prepare for Leadership Roles: Provide leadership and managerial skills essential for assuming high-level positions.

Career Paths

- Financial Analyst

- Investment Banker

- Corporate Finance Manager

- Risk Manager

- Financial Planner

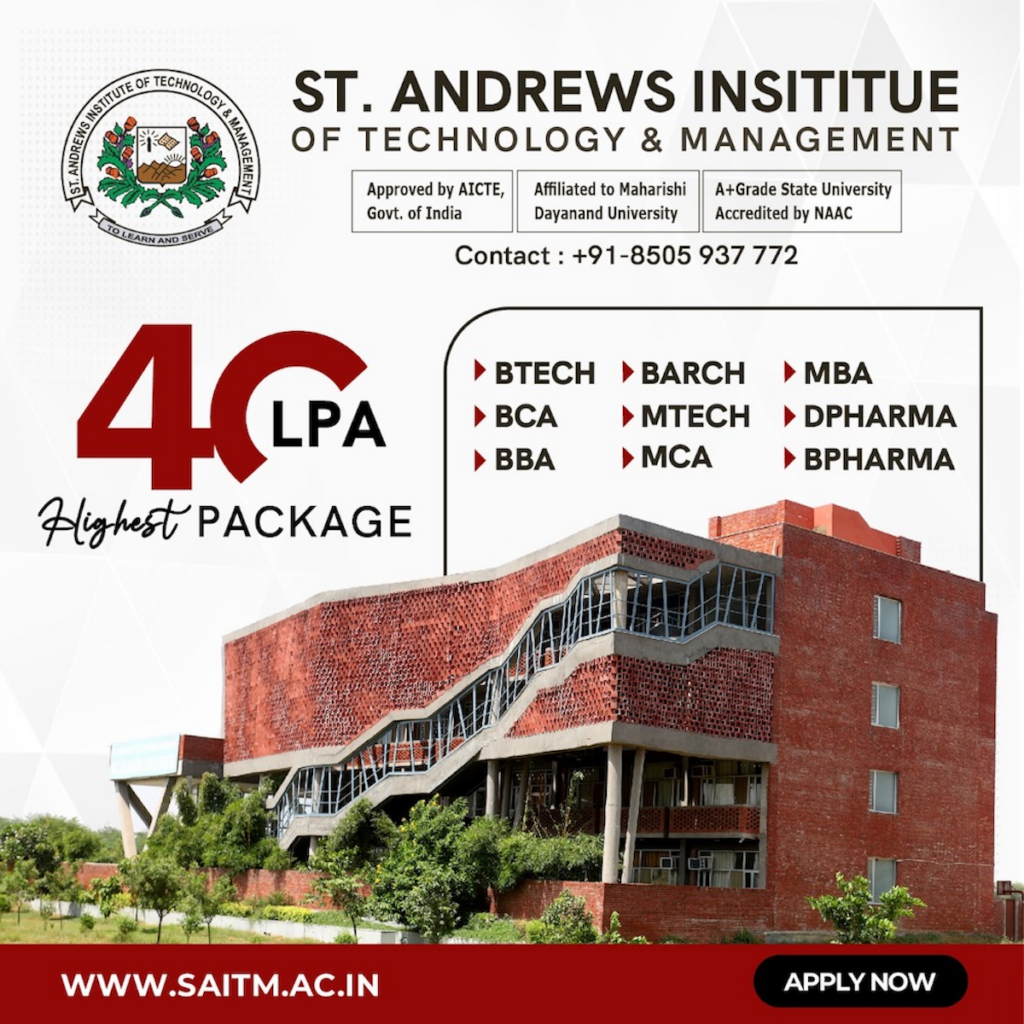

Some of the most opted courses in India and St. Andrews college or different Engineering college or Management colleges are as follows:-

- Btech

- Btech CSE

- Btech ETCE

- MTech

- BCA

- BBA

- MBA

- MCA

- DPharma – St. Andrews College of Pharmacy

- BPharma – St. Andrews College of Pharmacy

- BArch – St. Andrews College of Architecture

MBA in Finance Eligibility Criteria in India

The eligibility criteria for pursuing an MBA in Finance in India typically vary among institutions, but they generally include the following:

Educational Qualifications:

Candidates must have completed a bachelor’s degree (in any discipline) from a recognized university or institution. Usually, a minimum aggregate score in the undergraduate degree program is required, often around 50% to 60%, although this can vary depending on the institution.

Entrance Exams:

Many MBA programs in India require candidates to take specific entrance exams. The most common entrance exams for MBA programs include the CAT (Common Admission Test), XAT (Xavier Aptitude Test), MAT (Management Aptitude Test), and CMAT (Common Management Admission Test). Scores from these exams are often a significant factor in the admissions process.

Work Experience:

While not always mandatory, some MBA programs prefer candidates with prior work experience, particularly for executive MBA programs or those offering specialized tracks such as finance. Work experience requirements can vary but typically range from 0 to 2 years for regular MBA programs and may be higher for executive MBA programs.

Other Requirements:

Institutions may have additional requirements such as English language proficiency tests (like IELTS or TOEFL) for international students, letters of recommendation, statement of purpose (SOP), and/or personal interviews as part of the admissions process.

Specific Requirements for Finance Specialization:

While not necessarily part of the eligibility criteria, candidates interested in pursuing MBA in Finance may benefit from having a strong background in quantitative subjects such as mathematics, statistics, economics, or finance-related courses during their undergraduate studies. This can help them better cope with the rigorous curriculum of the finance specialization.

MBA Finance Syllabus: Overview

Core Courses

Financial Accounting

- Introduction to financial statements

- Balance sheets, income statements, cash flow statements

- Principles of accounting and financial reporting

Managerial Accounting

- Cost behavior and cost-volume-profit analysis

- Budgeting and forecasting

- Performance measurement and control systems

Corporate Finance

- Capital budgeting and investment decisions

- Capital structure and financing decisions

- Dividend policy and corporate governance

Financial Markets and Institutions

- Overview of financial systems and markets

- Roles of financial institutions

- Regulation and supervision of financial markets

Investment Analysis and Portfolio Management

- Security analysis and valuation

- Portfolio theory and asset allocation

- Risk management and derivatives

Financial Modeling and Valuation

- Building financial models

- Valuation techniques (DCF, multiples, etc.)

- Applications in mergers and acquisitions, leveraged buyouts

International Finance

- Foreign exchange markets and exchange rate determination

- International financial management and multinational corporations

- Global investment and financing strategies

Elective Courses

Advanced Corporate Finance

- Mergers and acquisitions

- Corporate restructuring and financial distress

- Strategic financial decisions

Derivatives and Risk Management

- Options, futures, and swaps

- Hedging strategies

- Risk assessment and mitigation techniques

Behavioral Finance

- Psychological factors in financial decision-making

- Market anomalies and investor behavior

- Implications for financial markets

Real Estate Finance

- Real estate investment analysis

- Financing real estate projects

- Real estate markets and valuation

Private Equity and Venture Capital

- Structure and function of private equity and venture capital markets

- Fundraising and investment processes

- Performance measurement and exit strategies

Capstone/Project Work

Strategic Financial Management Project

- Real-world financial problem solving

- Application of financial theories and models

- Comprehensive analysis and presentation of findings

Internship/Industry Practicum

- Practical experience in a financial role

- Exposure to financial decision-making processes in businesses

- Development of professional skills and network

Additional Skills Development

Quantitative Methods for Finance

- Statistical and econometric methods

- Quantitative analysis techniques

- Application in financial research and decision-making

Financial Technology (FinTech)

- Blockchain and cryptocurrencies

- FinTech innovations and trends

- Impact of technology on financial services

Ethics and Corporate Governance

- Ethical issues in finance

- Corporate governance frameworks and practices

- Role of finance professionals in promoting ethical behavior

MBA in Finance: Ranking, Reputation, and ROI

Indian Institute of Management Ahmedabad (IIM-A)

Ranking: Consistently ranked as the top business school in India by various national and international agencies.

Reputation: Known for its rigorous academic curriculum, experienced faculty, and strong industry connections.

ROI: High ROI with average starting salaries for finance graduates often exceeding INR 25-30 lakhs per annum. Strong placement records with top finance companies and investment banks.

St. Andrews Institute of Technology and Management (SAITM), Gurgaon

Ranking: Often ranked among the top college in India.

Reputation: Renowned for its strong finance program, excellent faculty, and vibrant campus life.

ROI: High ROI with average starting salaries around INR 10-40 lakhs per annum. Excellent placement opportunities with leading financial institutions.

Indian Institute of Management Calcutta (IIM-C)

Ranking: Frequently listed in the top three business schools in India.

Reputation: Known for its strong emphasis on finance and quantitative analysis, and a robust alumni network in the finance sector.

ROI: High ROI with average starting salaries in the range of INR 25-30 lakhs per annum. Strong placement support and industry connections.

Indian School of Business (ISB), Hyderabad

Ranking: Often ranked among the top five business schools in India.

Reputation: Known for its one-year MBA program, international faculty, and global exposure.

ROI: Good ROI with average starting salaries around INR 24-26 lakhs per annum. Strong industry connections and placement support.

XLRI – Xavier School of Management, Jamshedpur

Ranking: Consistently ranked among the top ten business schools in India.

Reputation: Known for its finance and human resources programs, strong ethics and values-based education.

ROI: High ROI with average starting salaries around INR 20-25 lakhs per annum. Good placement record and industry ties.

Faculty of Management Studies (FMS), University of Delhi

Ranking: Frequently ranked among the top ten business schools in India.

Reputation: Known for its strong finance curriculum, affordable fees, and excellent ROI.

ROI: Extremely high ROI with average starting salaries around INR 20-25 lakhs per annum, given the relatively low tuition fees.

Curriculum: Overview

Here are some common curricular activities:

Case Studies

Real-World Scenarios:

Analyze and solve complex business problems based on real-world financial situations.

Team Collaboration:

Work in teams to discuss and present case solutions.

Group Projects

Financial Analysis Projects:

Conduct financial analysis for companies or sectors.

Investment Portfolios:

Create and manage simulated investment portfolios.

Internships

Industry Experience:

Participate in internships with financial institutions, investment firms, or corporate finance departments.

Networking Opportunities:

Gain industry connections and practical experience.

Financial Simulations and Trading Labs

Simulated Trading:

Engage in simulated stock trading or commodity trading exercises.

Risk Management Exercises:

Practice managing financial risks through simulated environments.

Capstone Projects

Consulting Projects:

Provide financial consulting services to real companies.

Research Projects:

Conduct in-depth research on a finance-related topic and present findings.

Workshops and Seminars

Skill Development:

Attend workshops on financial modeling, advanced Excel, or Bloomberg terminal usage.

Industry Trends:

Participate in seminars led by industry professionals on current financial trends and practices.

Guest Lectures

Expert Insights:

Learn from guest lecturers who are experts in finance, such as CFOs, financial analysts, and investment bankers.

Networking:

Engage with professionals for career advice and networking.

Finance Competitions

Case Competitions:

Compete in national and international case competitions focused on finance.

Stock Pitch Competitions:

Present investment ideas and strategies to a panel of judges.

Student Finance Clubs

Networking and Learning:

Join finance clubs to network with peers, attend events, and participate in club activities.

Guest Speakers:

Invite finance professionals to speak at club events.

Conferences and Industry Events

Professional Development:

Attend finance-related conferences and industry events to stay updated on industry trends.

Networking:

Network with professionals and alumni at these events.

Study Tours

Global Exposure:

Participate in study tours to financial hubs like New York, London, or Hong Kong to gain international perspectives.

Company Visits:

Visit financial institutions and companies to learn about their operations and financial strategies.

Certifications

Professional Certifications:

Prepare for and obtain certifications such as CFA (Chartered Financial Analyst) or FRM (Financial Risk Manager) alongside the MBA program.

Research and Publications

Academic Research:

Engage in research projects with faculty and aim to publish findings in academic journals.

Industry Reports:

Contribute to industry reports or white papers on financial topics.

Admission Process for MBA in Finance

The admission process for an MBA in Finance typically involves several steps, though specifics can vary among institutions.

Here’s a general outline of the process:

Research and Shortlisting

Prospective candidates research MBA programs in Finance offered by various institutions and shortlist those that align with their academic and career goals.

Entrance Exam

Candidates usually need to appear for MBA entrance exams such as CAT (Common Admission Test), XAT (Xavier Aptitude Test), MAT (Management Aptitude Test), CMAT (Common Management Admission Test), depending on the requirements of the institutions they are applying to.

Application Submission

Candidates submit their applications to the selected institutions, which typically include details such as personal information, academic background, work experience (if applicable), entrance exam scores, and any other required documents such as transcripts, letters of recommendation, and statement of purpose (SOP).

Shortlisting for Interview

Based on the application and entrance exam scores, institutions shortlist candidates for the next stage, which often includes a personal interview. Some institutions may also consider other factors such as academic diversity, work experience, and extracurricular activities during the shortlisting process.

Interview

Shortlisted candidates are invited to participate in a personal interview, either in person or through video conferencing. The interview panel typically evaluates candidates on various parameters such as communication skills, problem-solving ability, leadership potential, and motivation for pursuing an MBA in Finance.

Final Selection

After conducting interviews, institutions finalize the selection of candidates based on a holistic assessment of their application, entrance exam scores, performance in the interview, and other relevant criteria. Selected candidates receive admission offers from the institutions.

Acceptance and Enrollment

Candidates who receive admission offers must confirm their acceptance by paying the required admission fees within the stipulated deadline. Upon acceptance, they enroll in the MBA in Finance program and complete any additional formalities required by the institution.

MBA Finance Fee Structure

Here’s a general overview:

Tuition Fees

This is the primary component of the fee structure and covers the cost of academic instruction. Tuition fees can range from a few lakhs to several lakhs of rupees for the entire program, depending on the institution. Government institutions usually have lower tuition fees compared to private institutions.

Other Fees

Institutions may also charge additional fees such as registration fees, examination fees, library fees, computer lab fees, and student association fees. These fees can vary and may or may not be included in the total tuition fees.

Hostel and Accommodation Fees

For students opting to stay in hostels or university accommodation, there will be additional fees for room rent, mess charges, security deposits, and other amenities. These fees can vary based on the type of accommodation and facilities provided.

Books and Study Materials

Students may need to purchase textbooks, reference materials, and other study resources separately. The cost for these materials can vary depending on the curriculum and requirements of the program.

Travel and Living Expenses

Students should also consider expenses for transportation, meals, groceries, personal expenses, and other living costs, especially if they are relocating to attend the MBA program.

Scholarships and Financial Aid

Many institutions provide scholarships, grants, and financial aid packages to eligible students based on merit, financial need, or other specific criteria. Prospective students should explore these opportunities to offset the cost of their MBA education.

Fee in Top Colleges

Here is the fee structure for an MBA in Finance at some of the top business schools in India. Note that these fees are approximate and can vary slightly depending on the specific program and any updates from the institutions:

Indian Institute of Management (IIM) Ahmedabad

Approximately INR 23-25 lakhs

St. Andrews Institute of Technology and Management (SAITM), Gurgaon

Approximately INR 4-5 lakhs

Indian School of Business (ISB), Hyderabad

Approximately INR 39-41 lakhs

Xavier School of Management (XLRI), Jamshedpur

Approximately INR 23-25 lakhs

Faculty of Management Studies (FMS), University of Delhi

Approximately INR 2 lakhs.

SP Jain Institute of Management and Research (SPJIMR), Mumbai

Approximately INR 20-22 lakhs

Narsee Monjee Institute of Management Studies (NMIMS), Mumbai

Approximately INR 20-22 lakhs

Benefits of Pursuing MBA in Finance

Here are some of the key advantages:

Advanced Skill Development:

MBA programs in finance provide in-depth knowledge and practical skills in areas such as fiscal management, investment analysis, corporate finance, risk management, and financial markets. This expertise equips graduates with the competencies needed to excel in various finance-related roles.

Career Advancement Opportunities:

An MBA in Finance enhances career prospects and opens up opportunities for advancement in the finance industry. Graduates can pursue roles such as investment banker, portfolio manager, corporate treasurer, risk manager, financial consultant, or chief financial officer (CFO).

Higher Earning Potential:

Finance professionals with an MBA typically command higher salaries compared to those with undergraduate degrees or lesser qualifications. The advanced education, specialized skills, and industry experience gained through the program can lead to increased earning potential over the course of one’s career.

Networking Opportunities:

MBA programs provide ample opportunities for networking with peers, alumni, faculty members, and industry professionals. Building a strong professional network can lead to job opportunities, career guidance, mentorship, and access to industry insights and resources.

Global Perspective:

Many MBA programs offer exposure to international business practices, global finance markets, and cross-cultural experiences. This global perspective is increasingly valuable in today’s interconnected world, where companies operate across borders and international finance plays a significant role.

Leadership Development:

MBA programs often include coursework and activities focused on leadership, strategic management, decision-making, and teamwork. These skills are essential for managerial and leadership roles in finance organizations and other sectors.

Versatility:

The skills and knowledge gained through an MBA in Finance are transferable across industries and sectors. Graduates can apply their expertise in finance roles within various sectors such as banking, consulting, technology, healthcare, manufacturing, and non-profit organizations.

Personal Growth:

Pursuing an MBA in Finance involves personal and professional development, including communication skills, critical thinking, problem-solving abilities, and ethical decision-making. These skills contribute to personal growth and prepare individuals to navigate complex business challenges and opportunities.

Credibility and Prestige:

Holding an MBA in Finance from a reputable institution enhances credibility and prestige in the eyes of employers, clients, and peers. It signals a commitment to continuous learning, professional development, and excellence in the field of finance.

Syllabus for MBA in Finance

core subject for MBA Finance

Financial Accounting:

This course introduces financial statements such as the balance sheet, income statement, and cash flow statement.

Managerial Accounting:

Topics covered may include cost behavior analysis, budgeting, variance analysis, and performance measurement.

Corporate Finance:

It includes capital budgeting, cost of capital, capital structure decisions, dividend policy, and corporate valuation techniques.

Financial Markets and Institutions:

Topics include interest rates, financial intermediation, and the role of central banks.

Specialization: Overview

Here are some common specializations available in MBA programs:

Corporate Finance

- Focuses on fiscal management within corporations.

- Topics include capital budgeting, financial analysis, and corporate valuation.

Investment Banking

- Prepares students for careers in investment banks.

- Topics include mergers and acquisitions, initial public offerings (IPOs), corporate restructuring, and financial advisory services.

Asset Management

- Deals with managing asset portfolios for individuals and institutions.

- Topics include portfolio theory, investment strategies, risk management, and asset allocation.

Financial Planning and Analysis (FP&A)

- Focuses on budgeting, forecasting, and financial planning within companies.

- Topics include financial modeling, strategic planning, performance analysis, and business forecasting.

Risk Management

- Emphasizes identifying, analyzing, and mitigating financial risks.

- Topics include derivatives, risk assessment techniques, insurance, and regulatory requirements.

Quantitative Finance

- Combines finance with quantitative techniques and models.

- Topics include financial engineering, quantitative trading, algorithmic strategies, and mathematical finance.

International Finance

- Focuses on fiscal management in a global context.

- Topics include foreign exchange markets, international investment, global financial strategy, and cross-border financial management.

Behavioral Finance

- Examines the psychological influences on investor behavior.

- Topics include cognitive biases, market psychology, and behavioral economics.

Real Estate Finance

- Study of financing and investing in real estate.

- Topics include real estate valuation, financing structures, property management, and market analysis.

Entrepreneurial Finance

- Focus on financial issues faced by startups and small businesses.

- Topics include funding sources, venture capital, and financial strategy for new ventures.

Types of MBA in Finance

Here are some common types of MBA programs in Finance:

General MBA with Finance Concentration:

This is the most common type of MBA in Finance program, where students complete a general Master of Business Administration (MBA) curriculum covering various business administration disciplines while choosing elective courses focused on finance. It provides a broad foundation in business management with a specialization in finance.

Dual Specialization MBA:

Some MBA programs allow students to pursue a dual specialization, where they can combine finance with another business discipline such as marketing, operations, or human resources. This provides students with a more comprehensive skill set and broader career opportunities.

Executive MBA (EMBA) in Finance:

EMBA programs are designed for experienced professionals seeking to advance their careers while continuing to work. EMBA programs typically offer a more condensed format with a focus on practical, real-world applications of finance concepts and strategies.

Part-Time MBA in Finance:

Part-time MBA programs are designed for working professionals who wish to earn an MBA while maintaining their full-time jobs. These programs typically offer evening or weekend classes, enabling students to balance their work and study commitments effectively.

Online MBA in Finance:

Online MBA programs offer flexibility for students who prefer to study remotely or need to balance their studies with work or other commitments. These programs typically deliver course materials and lectures online, allowing students to study at their own pace.

Specialized MBA Programs:

Some institutions offer specialized MBA programs with a specific focus within finance, such as Investment Banking, Risk Management, or Wealth Management. These programs provide in-depth knowledge and skills tailored to a particular area of finance.

International MBA in Finance:

International MBA programs frequently incorporate a worldwide outlook on finance, encompassing subjects like international finance, cross-border transactions, and global money markets. These programs may also offer opportunities for international internships or study abroad experiences.

Entrance Exams for MBA in Finance

IMAGE – 11 Convocation at SAITM

Here are some of the commonly recognized entrance exams for MBA programs:

CAT (Common Admission Test):

Commonly required for admission to MBA programs in India, the CAT is conducted by the Indian Institutes of Management (IIMs) and assesses candidates’ quantitative ability, verbal ability, data interpretation, and logical reasoning skills.

XAT (Xavier Aptitude Test):

Conducted by XLRI Jamshedpur, the XAT is another popular entrance exam for MBA programs in India. It assesses quantitative ability, English language skills, logical reasoning, decision making, and general awareness.

MAT (Management Aptitude Test):

Accepted by many business schools in India, the MAT assesses candidates’ aptitude in language comprehension, mathematical skills, data analysis, and critical reasoning.

CMAT (Common Management Admission Test):

Conducted by the National Testing Agency (NTA), the CMAT is accepted by AICTE-approved institutions in India and assesses candidates’ quantitative techniques and data interpretation, logical reasoning, language comprehension, and general awareness.

ATMA (AIMS Test for Management Admissions):

Accepted by various management institutions in India, the ATMA assesses verbal reasoning, numerical reasoning, and analytical reasoning skills.

Popular Private MBA in Finance Colleges in India

Here are some of the most well-known private MBA colleges in India for finance:

SP Jain Institute of Management and Research (SPJIMR), Mumbai:

SPJIMR is one of the top private business schools in India and is known for its rigorous MBA program with specializations in finance. The institute has strong industry connections and offers a variety of finance-related courses.

St. Andrews Institute of Technology and Management (SAITM), Gurgaon

SAITM offers an MBA program with specializations including finance. It is affiliated with Maharshi Dayanand University.

NMIMS School of Business Management, Mumbai:

NMIMS is a leading private business school in India offering an MBA program with a specialization in finance. The institute has a strong faculty and provides students with opportunities for hands-on learning through projects and internships.

International Management Institute (IMI), New Delhi:

IMI is a renowned private business school offering an MBA program with specializations in finance. The institute has a strong emphasis on industry exposure and provides students with opportunities for internships and placements in leading finance companies.

Top Government Colleges for MBA in Finance

Here are some of the top government colleges for MBA in Finance in India:

Indian Institutes of Management (IIMs):

Some of the top IIMs offering MBA in finance include IIM Ahmedabad, IIM Bangalore, IIM Calcutta, IIM Lucknow, and others.

St. Andrews Institute of Technology and Management (SAITM), Gurgaon

SAITM offers an MBA program with specializations including finance. It is affiliated with Maharshi Dayanand University.

Faculty of Management Studies (FMS), University of Delhi:

FMS Delhi is one of the oldest business schools in India and is known for its rigorous academic curriculum and excellent placement opportunities.

National Institute of Industrial Engineering (NITIE), Mumbai:

NITIE is known for its programs in industrial engineering and management. It offers a specialized MBA in Industrial Management with finance electives.

Xavier School of Management (XLRI), Jamshedpur:

Although XLRI is not a government institution, it is considered one of the top management schools in India. It offers a flagship PGDM program with specializations in finance.

Department of Financial Studies (DFS), University of Delhi:

DFS offers MBA and MBA (Finance) programs with a focus on finance-related subjects.

Top Colleges for MBA in Finance in India

Here are some of the top MBA colleges in India known for their strong finance programs:

Indian Institutes of Management (IIMs):

The IIMs are premier management institutions in India and are renowned for their MBA programs. Some of the top IIMs offering MBA in finance include IIM Ahmedabad, IIM Bangalore, IIM Calcutta, IIM Lucknow, and others.

St. Andrews Institute of Technology and Management (SAITM), Gurgaon

SAITM offers an MBA program with specializations including finance. It is affiliated with Maharshi Dayanand University.

Faculty of Management Studies (FMS), University of Delhi:

FMS Delhi is one of the oldest business schools in India and is highly regarded for its MBA program. It offers specializations in finance along with other areas of management.

Xavier School of Management (XLRI), Jamshedpur:

XLRI is among the top business schools in India and provides a specialized program in finance named PGDM (BM) with an emphasis on financial administration.

Indian School of Business (ISB), Hyderabad and Mohali:

ISB is a premier business school known for its one-year Post Graduate Program in Management (PGP), which offers electives in finance. It is ranked among the top business schools globally.

Top Recruiters for MBA Finance

Here are some of the top recruiters in MBA finance:

- Investment Banking:

- Goldman Sachs

- J.P. Morgan Chase

- Morgan Stanley

- Bank of America Merrill Lynch

- Citigroup

- Barclays

- Credit Suisse

- Deutsche Bank

- Consulting:

- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte Consulting

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

- Accenture

- Asset Management:

- BlackRock

- Vanguard Group

- Fidelity Investments

- Capital Group

- T. Rowe Price

- Franklin Templeton Investments

- Alliance Bernstein

- Wellington Management

- Private Equity and Venture Capital:

- The Carlyle Group

- KKR & Co.

- Blackstone Group

- Bain Capital

- Sequoia Capital

- Accel Partners

- Andreessen Horowitz

- General Atlantic

- Corporate Finance:

- General Electric (GE)

- Procter & Gamble (P&G)

- Johnson & Johnson

- Microsoft Corporation

- Amazon

- Apple Inc.

- Google (Alphabet Inc.)

- Financial Services:

- American Express

- Visa Inc.

- Mastercard

- PayPal

- Discover Financial Services

- Charles Schwab Corporation

- Wells Fargo

- American International Group (AIG)

- Insurance:

- MetLife

- Aflac

- Prudential Financial

- Allstate Insurance Company

- State Farm Insurance

- Liberty Mutual Insurance

- Travelers Companies Inc.

- AIG

- Real Estate:

- CBRE Group

- Jones Lang LaSalle (JLL)

- Cushman & Wakefield

- Brookfield Asset Management

- Blackstone Real Estate Partners

- Prologis

- Simon Property Group

- AvalonBay Communities

Career Opportunity After MBA Finance

Investment Banking:

Working in investment banks involves financial advisory services, mergers and acquisitions (M&A), capital raising, and corporate restructuring. Roles may include investment banking analyst, associate, or vice president.

Corporate Finance:

In corporate finance roles, professionals are involved in financial planning and analysis (FP&A), budgeting, treasury management, risk mitigation, and capital budgeting within a corporation. Opportunities exist in large corporations across all industries.

Equity Research:

Equity research analysts analyze financial data, industry trends, and company performance to provide investment recommendations to institutional investors and fund managers. This role is often found in investment banks, brokerage firms, and asset management companies.

Risk Management:

Risk managers assess and mitigate financial risks such as market risk, credit risk, and operational risk within financial institutions, corporations, and consulting firms.

Consulting:

Management consulting firms offer opportunities for MBA Finance graduates to work on financial strategy, business valuation, corporate restructuring, and financial performance improvement projects for clients across various industries.

Financial Planning and Analysis (FP&A):

FP&A professionals are responsible for financial forecasting, budgeting, variance analysis, and decision support for senior management within corporations. These roles are found in companies across industries.

Average Salary for MBA in Finance

Here’s a rough estimate of the average salary range for MBA graduates in Finance in India:

Entry-Level Positions:

For fresh MBA graduates in Finance, the average salary can range from ₹6 lakhs to ₹12 lakhs per annum. This typically includes roles such as Financial Analyst, Investment Banking Analyst, or Management Trainee in finance-related functions.

Mid-Level Positions:

With a few years of experience, MBA graduates in Finance can expect to earn higher salaries ranging from ₹12 lakhs to ₹20 lakhs per annum. Roles at this level may include Finance Manager, Senior Financial Analyst, or Assistant Vice President in finance departments of companies or financial institutions.

Senior-Level Positions:

MBA graduates with significant experience and expertise in Finance can command even higher salaries ranging from ₹20 lakhs to ₹50 lakhs or more per annum. At this level, roles may include Finance Director, Chief Financial Officer (CFO), Investment Banking Associate, or Vice President in finance-related functions.

FAQs

What does MBA finance do?

An MBA in Finance equips professionals with expertise in financial analysis, asset management, organizational finance, and risk assessment. They analyze financial data to guide investment decisions, manage portfolios, optimize company finances, and assess and mitigate risks. With a focus on ethical conduct and regulatory compliance, they navigate complex securities markets and contribute to the strategic financial management of organizations. Through specialized electives, they may delve into areas such as real estate finance, international finance, or fintech. Overall, MBA finance professionals play critical roles in driving financial success, maximizing shareholder value, and ensuring sustainable growth in various industries.

Is MBA finance a good option?

Opting for an MBA in Finance can be a strategic career move for individuals interested in the dynamic world of finance. It offers comprehensive training in financial analysis, asset management, and organizational finance, preparing graduates for diverse roles in banking, consulting, or organizational finance departments. With a strong foundation in ethical practices and regulatory compliance, MBA finance professionals are well-equipped to navigate complex financial landscapes. Moreover, the degree opens doors to lucrative career opportunities and positions of leadership within organizations. However, its value ultimately depends on individual career goals, industry demand, and the reputation of the program attended.

What is the salary in MBA finance?

Salaries for MBA finance professionals vary based on factors such as location, experience, industry, and company size. On average, entry-level positions such as financial analysts or associate consultants can earn around $60,000 to $100,000 annually. With several years of experience, mid-level roles like finance managers or senior consultants can command salaries ranging from $90,000 to $150,000. Senior executives, such as finance directors or vice presidents, often earn well over $150,000, with potential for significant bonuses and other incentives. Additionally, those in specialized areas like investment firms like banking or private equity can earn substantially higher salaries, often reaching into the six-figure range.

What is the scope of MBA in finance?

MBA Finance students enter a realm of broad and evolving possibilities. Upon graduation, they can chart varied career trajectories in banking, international banking, asset management, business finance, consulting, or financial analysis. Armed with proficiency in financial modeling, risk assessment, and strategic planning, they assume pivotal roles in optimizing profits, overseeing investments, and upholding financial stability within organizations. Additionally, opportunities exist in areas like fintech, where innovation intersects with traditional finance. As global markets continue to evolve, the demand for skilled finance professionals remains high, offering ample opportunities for career growth, leadership roles, and lucrative compensation packages in both domestic and international markets.

What is MBA Finance subject?

MBA Finance subjects encompass a broad spectrum of topics essential for understanding and navigating the complexities of fiscal management. Core subjects typically include financial accounting, business finance, investment analysis, and capital markets. Additionally, coursework often covers areas like financial modeling, risk management, and strategic financial management. Elective subjects allow students to specialize further, with options such as derivatives, international finance, or behavioral finance. Ethics and regulatory compliance are also emphasized. MBA Finance syllabus delivers a well-rounded education, empowering graduates with the requisite knowledge and skills to thrive in diverse finance-related positions spanning various industries.

Is MBA Finance hard?

MBA Finance can be challenging due to its rigorous curriculum and the complexity of financial concepts. Students must grasp quantitative methods, financial analysis, and strategic decision-making. The coursework often involves extensive use of financial models and data analysis, requiring strong analytical skills. Additionally, staying updated with industry trends and regulations is crucial. Success in MBA Finance demands dedication, critical thinking, and time management. However, with persistence and effective study strategies, students can overcome these challenges and excel in their academic pursuits. Ultimately, the difficulty level varies depending on individual strengths, prior knowledge, and the rigor of the program.

Is MBA Finance full of math?

While MBA Finance does involve mathematical concepts, it’s not solely focused on math. Mathematics serves as a foundation for understanding financial theories and models, but the emphasis is on applying these concepts to real-world financial scenarios. Students learn to use quantitative methods to analyze data, evaluate investment opportunities, and assess financial risks. While some courses may involve complex calculations and financial modeling, others focus more on strategic decision-making, financial analysis, and managerial skills. In Finance MBA programs, while a foundational understanding of math is advantageous, the emphasis lies on applying mathematical concepts practically within the framework of financial management.

Is it easy to study MBA in Finance?

Embarking on the journey to study MBA Finance offers a blend of gratification and challenge. Although the material can prove intricate, the level of difficulty hinges on one’s unique strengths, prior expertise, and the program’s intensity. Success requires dedication, critical thinking, and effective time management. Students must grasp quantitative methods, financial analysis, and strategic decision-making, which may involve extensive use of financial models and data analysis. However, with commitment and the right study strategies, many find the journey fulfilling. Access to resources such as professors, peers, and industry networks can facilitate the journey for Finance MBA candidates. Ultimately, despite its challenges, the experience can prove immensely beneficial and fulfilling.